Introduction

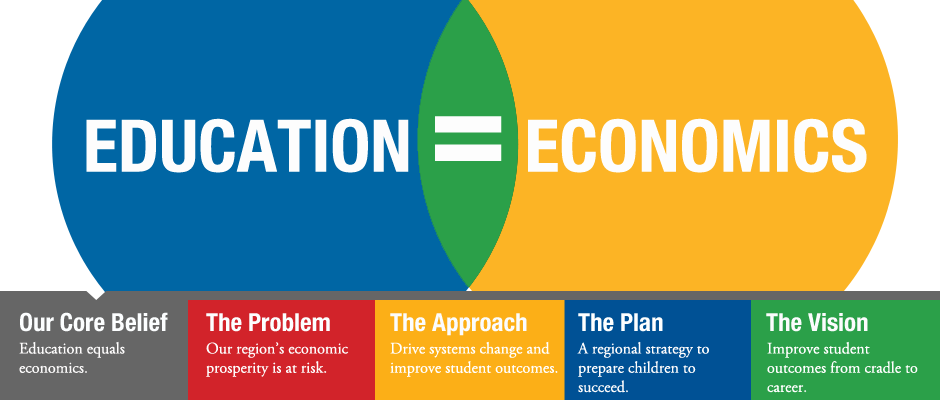

In today’s fast-paced world, economic education is essential for empowering young people with the knowledge and skills needed to make informed financial decisions. As financial systems grow more complex and students are increasingly exposed to money matters earlier in life, teaching economic principles is no longer optional—it’s vital. Economic education helps shape financially literate youth who can think critically about spending, saving, investing, and participating in the economy.

Understanding Economic Education

What Is Economic Education?

Economic education refers to the study and application of basic and advanced economic concepts. This includes understanding how markets work, the importance of financial institutions, the role of government in the economy, and personal finance skills such as budgeting, investing, and credit management.

Why It’s Relevant for Youth

Teaching young people economics gives them a lens through which to view the world. From understanding the cost of living to navigating student loans and credit cards, economic education equips students with essential tools for adulthood.

Benefits of Economic Education for Students

1. Enhances Financial Literacy

One of the most direct outcomes of economic education is increased financial literacy. Students learn to budget, save, plan for the future, and understand the impact of financial decisions.

2. Develops Critical Thinking

Economics involves evaluating trade-offs, analyzing data, and making decisions based on evidence. These skills transfer directly to real-life decision-making and problem-solving.

3. Encourages Responsible Consumer Behavior

By understanding how markets function and what drives prices, students become more thoughtful consumers. They are less likely to fall for financial scams or accumulate unnecessary debt.

4. Prepares for the Workforce

Economic education builds a foundation for many career paths and provides students with the financial awareness needed to manage salaries, taxes, and benefits effectively.

5. Promotes Civic Understanding

A solid grasp of economics enhances civic awareness. Students better understand topics like taxation, public spending, inflation, and national debt, encouraging informed participation in democracy.

Integrating Economic Education in the Classroom

Starting in Early Education

Basic economic concepts—like needs versus wants, goods and services, and the concept of trade—can be introduced in elementary school. This lays the foundation for more advanced lessons later.

Incorporating into Existing Subjects

Teachers can integrate economic lessons into subjects such as:

- Math (budgeting, interest, statistics)

- Social Studies (taxes, government policy, trade)

- Language Arts (reading and writing about economic topics)

- Business and Entrepreneurship programs

Using Real-Life Examples

Bringing current events and real-world scenarios into the classroom helps students see how economics affects their lives. Discussions about inflation, recessions, or housing markets make abstract ideas tangible.

Project-Based Learning

Hands-on projects such as classroom businesses, mock stock markets, or personal finance journals help reinforce economic principles and keep students engaged.

Teaching Strategies for Economic Education

1. Simulations and Games

Interactive tools like online simulations, board games, and budgeting apps can make economic education fun and memorable.

2. Guest Speakers and Community Involvement

Bringing in local entrepreneurs, financial advisors, or economists can add depth and provide real-world perspectives.

3. Curriculum Resources

Use standards-aligned resources such as:

- The Council for Economic Education (CEE)

- Next Gen Personal Finance (NGPF)

- Junior Achievement programs

4. Financial Literacy Events

Schools can host financial literacy weeks, workshops, or competitions to raise awareness and encourage engagement.

Overcoming Barriers to Economic Education

1. Lack of Teacher Training

Not all educators feel confident teaching economics. Professional development and access to quality resources can help bridge this gap.

2. Limited Curriculum Time

Schools face pressure to focus on core subjects. Integrating economic principles into those subjects offers a practical workaround.

3. Socioeconomic Disparities

Students from lower-income backgrounds may have limited exposure to economic opportunities. Economic education can provide critical knowledge that empowers them to break generational cycles of poverty.

4. Perception That It’s Not Essential

Some believe economics is too abstract or not relevant to younger students. However, when taught well, it becomes a practical and powerful life skill.

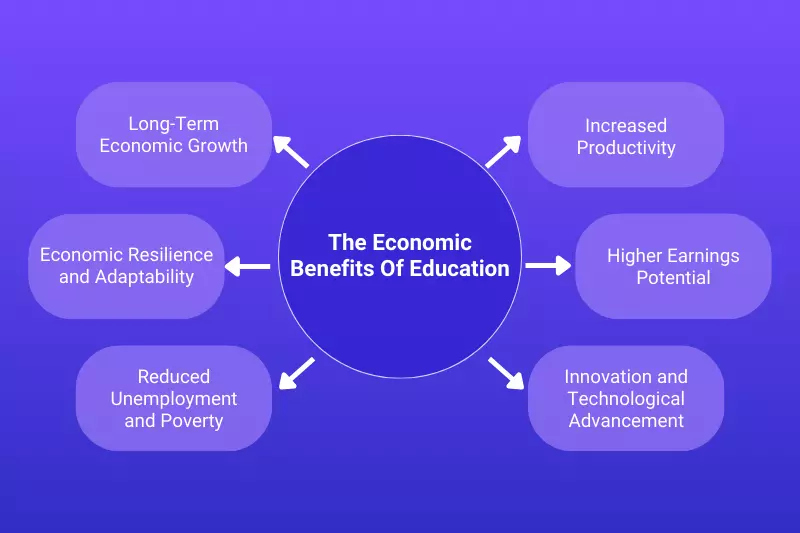

The Long-Term Impact of Economic Education

Economic education doesn’t just help students during their school years—it sets them up for lifelong success. Financially literate individuals are more likely to:

- Avoid debt traps

- Save and invest wisely

- Plan for retirement

- Make informed career and life choices

- Participate in economic and civic systems responsibly

By embedding economics in education early, schools contribute to building a more financially capable and equitable society.

Also Read : What Are The Best Study Techniques For Effective Learning?

Conclusion

Economic education is more than an academic subject—it’s a life skill. By teaching young people how economies function and how to make sound financial decisions, educators prepare them not just to survive, but to thrive in an increasingly complex world. As financial challenges continue to grow globally, equipping students with strong economic foundations is one of the most impactful steps teachers and schools can take. Financial literacy is not a privilege—it’s a necessity, and economic education is the path to achieving it.

FAQs

What is the difference between economic education and financial literacy?

Economic education covers broader topics like markets, government policy, and supply and demand, while financial literacy focuses more on personal finance, such as budgeting, saving, and managing debt.

At what age should students start learning about economics?

Basic economic principles can be introduced in elementary school. As students grow, lessons can evolve into more advanced topics like investing, taxation, and economic systems.

What are some good resources for teaching economic education?

Organizations like the Council for Economic Education (CEE), Junior Achievement, and Next Gen Personal Finance (NGPF) offer excellent free resources and lesson plans.

Why is economic education important in high school?

High school students are close to entering adulthood and facing real-world financial decisions. Economic education helps prepare them to make smart, informed choices.

Can economic education reduce financial inequality?

Yes, by teaching all students the same foundational financial skills, economic education can help level the playing field and promote long-term financial independence.