An insurance broker helps connect people with insurance companies. They use their knowledge and the client’s information to get the right policy. The goal is to find a good policy at a fair price. This can save time and money, even though clients might need to pay a broker fee. They’re especially helpful for those with complex insurance needs such as landlords or small business owners with different policies.

Brokers get paid by insurance companies for finding clients and also by charging fees. They work for the buyer. In comparison, independent agents serve the insurance companies. A big difference is that brokers can check out many insurers, but agents have fewer choices.

Key Takeaways

- Insurance brokers act as intermediaries between clients and insurance companies.

- Brokers use their expertise to find the best policies that meet the client’s needs.

- Brokers can save clients time and money, but may charge a broker fee.

- Brokers represent the buyer, while independent agents represent insurance companies.

- Brokers have access to multiple insurers, while agents are often limited to certain policies.

Also Read : How Does Diet Affect Kidney Disease?

The Role of an Insurance Broker

Insurance brokers are key players in the world of insurance. They act as the middlemen between people and insurance companies. With their deep knowledge, they help clients pick the right insurance policies. They look into what the client needs and then scope out the market to find the best deals.

Also Read : Top 10 Healthy Eating Tips You Need To Know

Expert Guidance on Policy Selection

Brokers are experts at picking out the perfect insurance plans. They carefully look at what you need, what could go wrong, and how much you want to spend. Then, they recommend the best policies. Their advice helps you understand what your policy covers and what it doesn’t.

Risk Management Strategies

Brokers don’t just stop at picking the right policies. They also help you come up with ways to manage your risks. They figure out what might put you in danger and then suggest insurance or other ways to stay safe. This way, you have peace of mind that someone’s looking out for you.

Also Read : What Is Credit Risk And Why Is It Important In Finance?

When to Use an Insurance Broker

An insurance broker is great for people and companies with complex insurance needs. They are a big help for those with multiple properties or vehicles. They can make sure every asset has the best coverage.

Brokers offer a deep understanding of policy details, exclusions, and limits. This is key for those looking for business insurance.

Also Read : Top 10 Benefits Of Apples For Your Health

Multiple Properties or Vehicles

If you have many properties or vehicles, getting the right insurance is tough. Brokers have connections and know-how that simplify things. They can secure policies that ensure the best protection and value for their clients.

Comprehensive Policy Understanding

Insurance policies are often tricky, with hidden details in the fine print. But brokers know how to make sense of all this. Their expertise is essential for making smart choices and staying safe from risks.

Also Read : How Can Celebrating Small Successes Keep Students Motivated?

Business Insurance Needs

For businesses, insurance can be quite complex. Insurance brokers are there to guide business owners. They help choose the right mix of coverages for the company’s risks and needs.

Brokers use their deep knowledge and professional relationships to find the most comprehensive and cost-effective policies. This is vital for ensuring a business is well-protected.

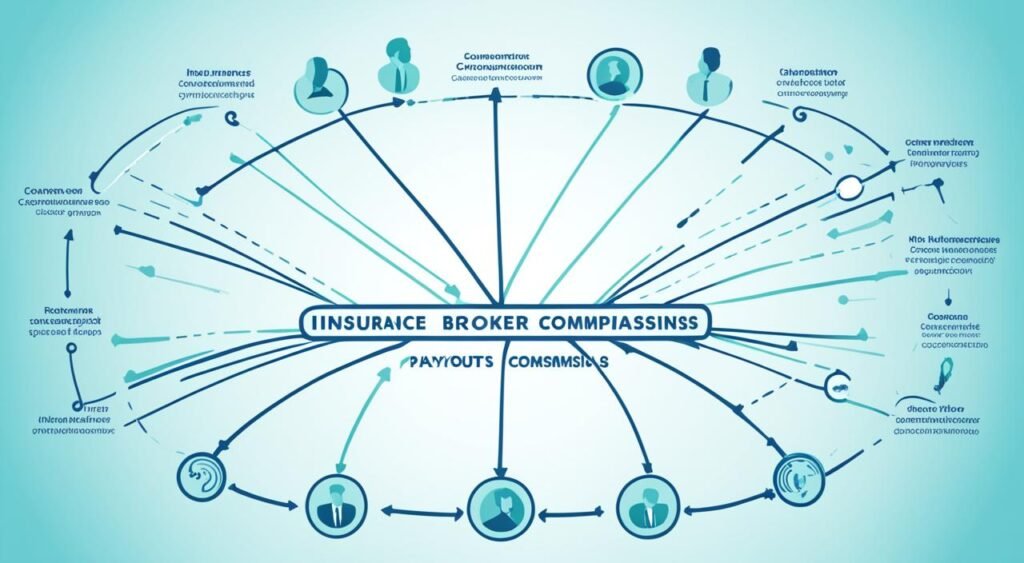

How Insurance Brokers are Compensated

Insurance brokers make money mostly by getting commissions from insurers. These fees come from the companies where they place their clients. Commissions can be from 2% to 8% of the policy’s cost. It depends on where you live and what the broker and insurer agree on.

Commissions from Insurers

Brokers earn most of their money from insurance companies. They help their clients find the right policies. Because of this help, insurance companies then pay brokers a part of the policy’s price.

Broker Fees

On top of earning from companies, some insurance brokers also add broker fees.These fees should be fair and clearly told to clients at the start. If a client drops the policy, they usually can’t get the fee back. Brokers work hard to make their clients happy, since they might have to give back their commission if the policy is canceled early.

Insurance Broker vs. Independent Agent

Insurance brokers and independent agents are similar in some ways. They both work with many insurance companies and make money from commissions. Yet, the key difference is how they represent clients and what policies they can offer.

Insurance brokers look out for the client’s best interests. They search for the best policies based on the client’s needs. Since they can check many insurance providers, they find the best coverage and prices. On the other hand, independent agents serve the interests of the insurance companies they are aligned with, limiting the policies they provide to those specific products.

One big difference is in binding coverage. Insurance agents (whether independent or captive) can seal the deal for the insurance company. But insurance brokers can’t. They need the insurance company or its authorized agents to close the deal.

The advice they give also differs. Brokers offer objective, client-focused advice to get the best policies. Independent agents might know more about certain insurance products. Their guidance, however, may be swayed by the needs of the companies they represent.

| Characteristic | Insurance Broker | Independent Agent |

|---|---|---|

| Representation | Represents the client’s interests | Represents the insurance companies |

| Policy Offerings | Access to multiple insurance providers | Limited to specific insurance products |

| Binding Coverage | Cannot bind coverage | Can bind coverage on behalf of insurers |

| Advice Approach | Objective, client-focused | May be influenced by insurer interests |

In short, the differences between insurance brokers and independent agents are clear. They vary in how they represent, the policies they offer, binding abilities, and their advice style. Knowing these distinctions helps clients choose the right professional for their insurance needs.

Advantages of Using an Insurance Broker

Using an insurance broker is a smart choice. They can check many insurance companies to find what’s best for you. With access to multiple insurers, brokers offer advice that’s just for you, with no special interests.

Brokers know a lot and offer personalized service. They deeply know your needs. This helps find the right cover and support you when you need it most. This is great if your insurance needs are a bit complicated.

| Advantage | Description |

|---|---|

| Access to Multiple Insurers | Brokers can shop multiple insurance providers to find the best rates and coverage options for the client’s needs. |

| Personalized Service | Brokers take the time to understand the client’s unique background, risks, and insurance requirements. |

| Expertise and Industry Knowledge | Brokers leverage their extensive industry knowledge and relationships to guide clients to the most suitable policies. |

Types of Insurance Handled by Brokers

Insurance brokers deal with various types of insurance like home and renters insurance, auto insurance, business insurance, and life insurance. They use their expertise and connections to different insurers. This helps them find ideal coverage for each client’s needs.

Home and Renters Insurance

Brokers help clients with home and renters insurance. They make it easy to understand different coverage, deductibles, and limits. Knowing about the client’s home, belongings, and risks allows brokers to suggest the right insurance. This ensures full protection.

Auto Insurance

Dealing with auto insurance, brokers make sure clients get the best for their cars or trucks. This includes different coverages like liability and comprehensive. They might also recommend combining auto insurance with other types. This can save money.

Business Insurance

For those who own businesses, having the right business insurance is vital. Brokers assist in choosing policies that protect the company, such as property or liability insurance. They match the insurance to the business’s size and unique needs.

Life Insurance

Brokers are also helpful with life insurance. They steer clients to the correct policy and the right coverage. By looking at the client’s finances, family, and future plans, they recommend life insurance that offers needed protection.

No matter the insurance need, a skilled broker can ensure proper coverage. They connect clients with the best policies from several insurers.

Qualifications and Licensing of Insurance Brokers

To become an insurance broker, you usually need a bachelor’s degree. This is often in fields like sales or business. You also need to be good at talking to people and doing research. Brokers must have a license in the state they work in. They also need to pass special tests, such as the Series 6 and Series 7. They have to keep learning and follow all the insurance rules of their state. Brokers keep track of changes in insurance laws. They do this to make sure they always give the best and correct advice to their clients.

The qualifications of an insurance broker are clear. They need to know a lot about the insurance world. They must be able to figure out what each client needs and choose the right policies. Good communication and negotiation skills are a must for them. They use these skills to get the best insurance deals for their clients.

| Qualification | Requirement |

|---|---|

| Education | Bachelor’s degree, often in a field like sales or business |

| Licensing | State-issued license and passing FINRA exams (Series 6, Series 7) |

| Ongoing Education | Continuous training and compliance with state insurance regulations |

| Industry Knowledge | Expertise in insurance policies, coverage options, and risk management strategies |

| Communication Skills | Effective client advocacy, negotiation, and customer service abilities |

By working hard to meet these insurance broker qualifications and keeping their insurance broker licensing up to date, brokers help their clients in many ways. They offer expert advice and find the best insurance solutions. Brokers are a key link between insurance companies and the people who need policies.

Choosing the Right Insurance Broker

When you pick an insurance broker, you must look at their specialization, how clear they are about their pay, and how they talk and treat customers. By checking all this, you can make sure you pick a broker who can meet your specific insurance needs well.

Specialization

Brokers focusing on the kind of insurance you need, like home, auto, or business coverage, can give better advice. They know a lot about these insurance types. This makes it easier to find the right policies and coverage for you.

Transparency in Compensation

Always ask about the broker’s compensation, including any commissions or broker fees. Knowing these financial details is important. It helps avoid surprises or any issues with the advice you get.

Communication and Customer Service

How a broker talks and takes care of clients is key. Choose a broker who’s easy to reach, reaches out to you, and offers support whenever needed. This personal touch is important in dealing with your insurance.

Insurance Broker

An insurance broker serves as a middleman between you and the insurance company. They work in your best interest, not the insurance company’s. With their deep industry knowledge and connections, they can find the best insurance for you from various providers. Brokers earn money mainly through commissions from the insurers. Sometimes, they might also charge fees. This sets them apart from agents working directly for one insurance company. Brokers focus solely on what is best for you.

Services Offered by Insurance Brokers

Insurance brokers do more than just find the right policies. They offer many services to meet their clients’ insurance needs. This makes brokers a reliable partner for handling all insurance matters.

Policy Comparisons

Policy comparisons are a big part of what brokers do. They check various insurers to find the best coverage that fits the client’s needs and wallet. This is made possible by their deep knowledge and network in the industry.

Claims Assistance

Brokers jump in to help when something unexpected occurs. They guide clients through filing claims, ensuring they get speedy and fair responses from the insurance company. This service shines for clients who find insurance details hard to digest or who need help with bargaining for better outcomes.

Risk Assessments

Brokers also offer risk assessments. They look at what their clients might face and suggest ways to manage these risks. This forward-thinking support allows clients to not just react but to proactively handle their insurance needs.

Also Read : 7 Tips To Help You Get the Best Auto Insurance Deals

Regulations and Compliance for Insurance Brokers

In the United States, insurance brokers face many rules and compliance checks. This is to make sure they act in the right way for their clients. Insurance broker regulations mean that brokers must have a license for each state they work in. They have to renew these licenses every other year.

Becoming and staying a licensed broker means keeping up with insurance laws and rules. Staying educated helps them give good and proper advice to their clients. It helps them keep their knowledge fresh on any regulatory changes.

Brokers also have a key rule to follow: always work in their clients’ best interests. This means being open about how they get paid. They must tell clients about any money they make from insurance companies or fees they charge.

They need to share any situations where their advice might not be completely free from their own interests. This ensures the advice given to clients is honest and objective.

Governing bodies at the state level keep an eye on brokers. They make sure insurance brokers follow the rules. If a broker doesn’t follow the rules, they may be fined or even lose their license. So, keeping up with all the rules is very important for these professionals.

Conclusion

Insurance brokers are key in the world of insurance, helping people and businesses. They bridge the gap between clients and insurance companies. Brokers use their knowledge and connections to find suitable policies at good prices. They work on all levels, from personal, for homes and cars, to business insurance.

Brokers earn through commissions and fees, but their focus on clients can save money and improve coverage over time. It’s crucial to pick a broker who’s right for you. They should focus on your needs, be clear about how they earn, and offer great service.

So, insurance brokers do a lot. They guide clients, connect them with many insurers, and offer thorough services. Picking the right broker is vital, ensuring you get both quality service and the best coverage for your needs.